There's a new beat on the street, the use and benefits of Product Portfolio Management.

The current leader is Tribold.

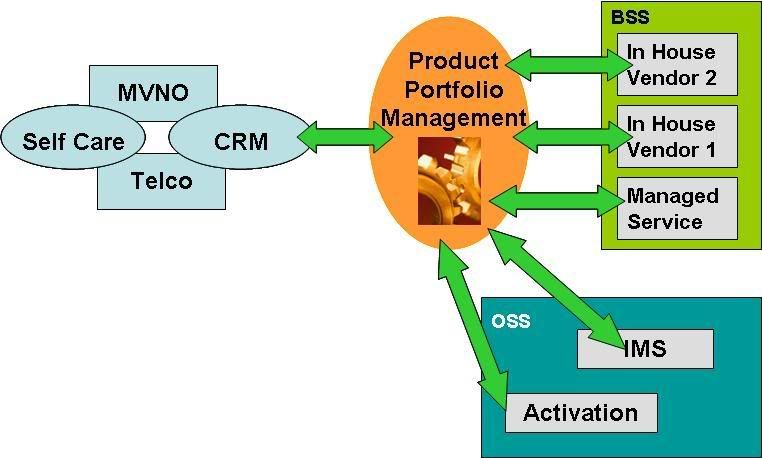

The intention is to get products to market faster, this is targeted at Telecom companies with a known time to market problem. The idea centralize the product management function that has a single view and representation of a product. This can then be shared with CRM, OSS and BSS systems.

With powerful reporting that can show take up of the offering and the unified product master when CRM, OSS and BSS will be in synch this should be a great boost for offering promotion to market. It's also not limited to telecom as this is a problem that many enterprises face today with disparate applications using the data (CRM, Self Care, Financials, Manufacturing, Distribution).

The great enabler for me is that will allow MVNO's to communicate their product vision to OSS and BSS provider of choice. The trend will be for pick best of breed billers for market segments, for example converged solution at the youth or business market and a less capable (and therefore less expensive) solution at pure voice users. Having a single view of a product means that IMS provisioning will be more simplified. With any product any screen provisioning attributes will vary by subsystem. A PPM solution will allow for that.

The benefits to operators is also making the migration to or between vendors easier. With a central repository for products it you wanted to switch from Siebel to SugarCRM this doesn't mean a mass migration of the whole product catalog, a new interface to pass the existing representation from PPM to CRM should make the process faster and more efficient.

The current leader is Tribold.

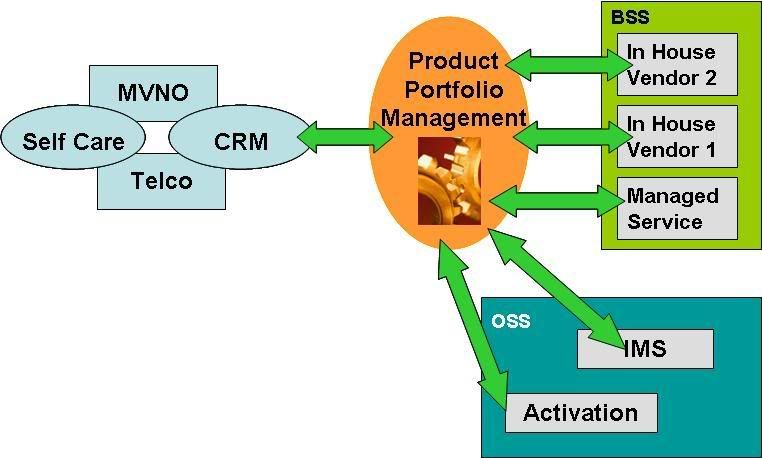

The intention is to get products to market faster, this is targeted at Telecom companies with a known time to market problem. The idea centralize the product management function that has a single view and representation of a product. This can then be shared with CRM, OSS and BSS systems.

With powerful reporting that can show take up of the offering and the unified product master when CRM, OSS and BSS will be in synch this should be a great boost for offering promotion to market. It's also not limited to telecom as this is a problem that many enterprises face today with disparate applications using the data (CRM, Self Care, Financials, Manufacturing, Distribution).

The great enabler for me is that will allow MVNO's to communicate their product vision to OSS and BSS provider of choice. The trend will be for pick best of breed billers for market segments, for example converged solution at the youth or business market and a less capable (and therefore less expensive) solution at pure voice users. Having a single view of a product means that IMS provisioning will be more simplified. With any product any screen provisioning attributes will vary by subsystem. A PPM solution will allow for that.

The benefits to operators is also making the migration to or between vendors easier. With a central repository for products it you wanted to switch from Siebel to SugarCRM this doesn't mean a mass migration of the whole product catalog, a new interface to pass the existing representation from PPM to CRM should make the process faster and more efficient.

Comments

Outsourcing Solution in BPO